What the Wealthy Know About Offshore Trusts That You Don’t

What the Wealthy Know About Offshore Trusts That You Don’t

Blog Article

The Crucial Guide to Establishing up an Offshore Depend On for Estate Planning and Tax Effectiveness

If you're taking into consideration means to protect your possessions and prepare for the future, setting up an offshore trust may be a smart move. These depends on can supply you with personal privacy, tax benefits, and a structured way to move riches. Guiding with the complexities of overseas depends on needs cautious planning and experience. Comprehending the vital benefits and legal factors to consider is crucial as you discover this option for your estate preparation strategy.

Understanding Offshore Trusts: An Overview

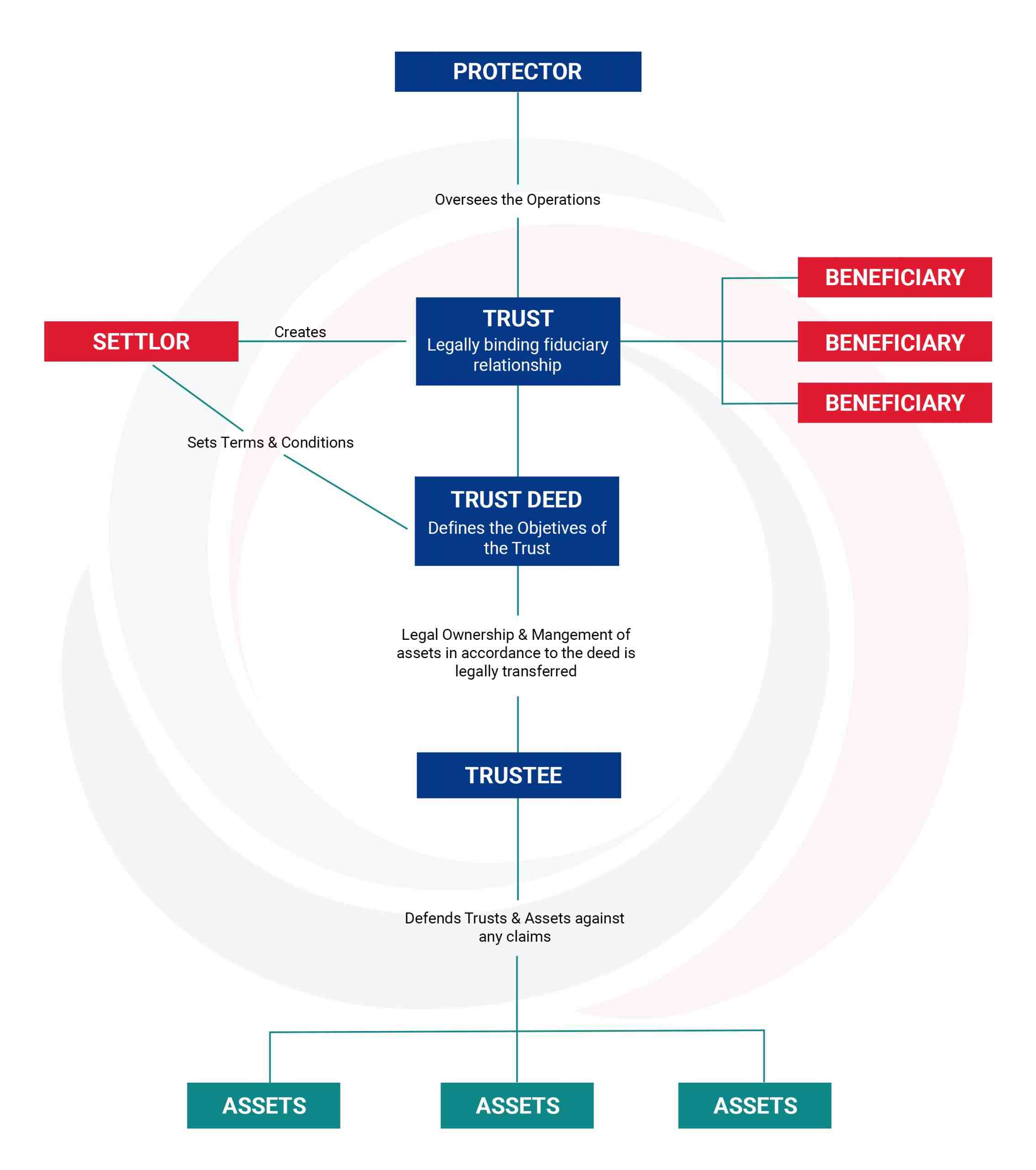

When you're discovering estate planning alternatives, comprehending overseas counts on can be significant. An overseas trust is a lawful arrangement where you place your properties in a depend on taken care of by a trustee in a foreign jurisdiction. This setup can assist you protect your wealth and guarantee it's dispersed according to your wishes.

You'll normally choose a territory known for positive trust fund laws and personal privacy protections. It's crucial to understand the distinction between a domestic trust and an offshore trust, as the last frequently provides distinct advantages, such as possession protection versus financial institutions and possible tax advantages.

Before diving in, you should think about the lawful and tax obligation effects both in your home country and the jurisdiction where the trust fund is established. Collaborating with a certified lawyer or economic advisor is vital to navigate this complicated landscape properly. Understanding these fundamental aspects will certainly encourage you to make enlightened choices regarding your estate preparation method.

Secret Advantages of Developing an Offshore Count On

Developing an offshore trust supplies a number of engaging benefits that can boost your estate preparation approach. By placing your assets in an overseas depend on, you can additionally enjoy possible tax advantages, as some territories use desirable tax obligation treatment for trusts.

In addition, offshore counts on use enhanced personal privacy. Unlike residential trust funds, which may undergo public examination, overseas trust funds can assist maintain privacy regarding your monetary affairs. This personal privacy expands to your recipients, shielding their inheritance from unwanted focus.

Additionally, overseas depends on can assist in smoother riches transfer throughout generations, circumventing probate procedures that may delay property circulation. On the whole, developing an offshore trust fund is a strategic transfer to safeguard your assets, enhance tax efficiency, and assure your estate intending goals are satisfied successfully.

Sorts Of Offshore Trusts and Their Purposes

Offshore counts on come in various kinds, each made to offer particular objectives within your estate preparation technique. One common type is the optional depend on, where the trustee has versatility in dispersing properties among recipients. This can help secure your estate from financial institutions and give financial backing to your enjoyed ones based on their demands.

An additional alternative is the set trust, where recipients obtain established shares of the count on properties. This structure is optimal for making sure equal circulation among beneficiaries.

You could also take into consideration a spendthrift trust fund, which safeguards properties from beneficiaries who might not manage cash wisely. This enables you to attend to their demands while safeguarding the estate.

Last but not least, there's the charitable count on, which profits a charitable organization while possibly offering tax benefits for you. Each type of overseas trust can help attain different objectives, so it is important to pick one that straightens with your estate intending objectives.

Legal Factors To Consider for Establishing an Offshore Trust Fund

Prior to you established an offshore count on, it's crucial to recognize the legal considerations included. You'll require to ensure conformity with both your home nation's regulations and the laws of the offshore territory you select. Lots of countries require you to report offshore depends on, so be planned for potential tax ramifications.

Next, think about the count on's framework. Different types of trusts may supply varying levels of possession defense and tax obligation benefits, depending on local laws. You need to likewise clear up the duties of the trustee and recipients, as these relationships can significantly impact how the trust fund operates.

In addition, know anti-money laundering laws and various other laws that may apply. Consulting with attorneys experienced in overseas depends i thought about this on is vital to navigate these intricacies properly. Complying with these lawful standards can help you stay clear of mistakes and make certain your offshore trust fund serves its objective effectively.

Steps to Develop an Offshore Count On

With a solid understanding of the legal factors to consider, you can now take actions to establish an offshore depend on. First, pick a reliable territory that straightens with your goals and offers strong privacy defenses. Next, pick a reliable trustee that understands the complexities of taking care of overseas trusts. You'll wish to review your details requirements and purposes with them.

After that, prepare the depend on act, detailing the terms, recipients, and the properties you intend to move. Make particular to get in touch with legal and financial advisors to ensure compliance with regional regulations. When the act is wrapped up, money the depend on by moving properties, which could consist of money, actual estate, or investments.

Finally, maintain precise documents and check the trust fund's performance on a regular basis. This assists you establish that it's working as meant and straightens with your estate intending objectives. Adhering to these steps will certainly place you on the path to creating an effective offshore count on.

Tax Obligation Implications of Offshore Counts On

While thinking about an offshore depend on, it's crucial to recognize the tax obligation effects that can arise. Depending on the trust's structure, you could encounter revenue tax obligation on circulations or gains produced within the depend on.

Furthermore, if the depend on is deemed a grantor trust, you'll be in charge of reporting its earnings on your personal income tax return. It's important to differentiate between revocable and irrevocable trust funds, as their tax therapies vary significantly.

While offshore trusts can supply possession protection and personal privacy advantages, they will not necessarily secure you from U.S. tax obligations (Offshore Trusts). Consulting a tax obligation professional experienced in global regulations is very important to browse these complexities and assure conformity while making the most of the advantages of your offshore depend on

Typical False Impressions Regarding Offshore Trust Funds

When it involves overseas counts on, numerous individuals believe they're just for the well-off or that they're illegal. Actually, offshore trusts can be a lawful you can try these out and reliable estate preparation device for anybody looking to secure their properties. Let's clean up these typical mistaken beliefs and discover what offshore trusts can really use.

Validity and Conformity Issues

Several individuals mistakenly think that offshore trusts are inherently illegal or entirely a tool for tax evasion. In fact, these trusts can be completely legal when set up and preserved in compliance with the legislations of both your home country and the territory where the count on is developed. You'll require to reveal the presence of an overseas trust to tax obligation authorities and ensure that you're adhering to reporting requirements.

Affluent Individuals Only Misconception

Offshore depends on aren't simply for the ultra-wealthy; they can be beneficial devices for any person aiming to shield their assets and plan their estate. Lots of people incorrectly think that just the rich can gain from these depends on, however that's merely not true. People with moderate wide range can additionally utilize offshore trusts to safeguard their properties from financial institutions, legal actions, and potential tax obligations. In addition, these trust funds can supply greater personal privacy and flexibility in estate planning. By resolving the myth that offshore trusts are exclusively for the elite, you open up new possibilities for securing your economic future. Do not allow false impressions hold you back; explore how an offshore depend on may be a clever choice for your estate preparing requirements.

Frequently Asked Inquiries

Just how much Does It Price to Establish an Offshore Depend On?

Establishing up an overseas trust can set you back anywhere from a couple of thousand to 10s of thousands of dollars (Offshore Trusts). You'll need to take into account legal charges, administration expenses, and any type of ongoing maintenance expenditures that may develop

Can I Handle My Offshore Count On From My Home Country?

Yes, you can handle your offshore depend on from your home country. Nevertheless, it's important to recognize the legal implications and tax obligation policies included. Consulting with a legal expert can assist guarantee you're certified and notified.

What Possessions Can Be Placed in an Offshore Trust Fund?

Are Offshore Trusts Legal for Every Person?

Yes, overseas counts on are lawful for everybody, but their legality differs by territory. You'll need to understand your local laws and guidelines to ensure conformity, so it's try this website smart to seek advice from a legal specialist before proceeding.

Exactly how Do I Choose a Trustee for My Offshore Depend On?

Choosing a trustee for your overseas trust entails examining their experience, reliability, and understanding of your certain needs. You must also consider their charges and how well you interact with them to ensure a successful collaboration.

Report this page